Navigating TRICARE can be challenging, especially when it comes to understanding the catastrophic cap. This guide provides clear, actionable steps to help military families understand and plan for their healthcare costs in 2025. We'll explain the intricacies of this crucial benefit, empowering you to make informed financial decisions.

Understanding TRICARE's Catastrophic Cap

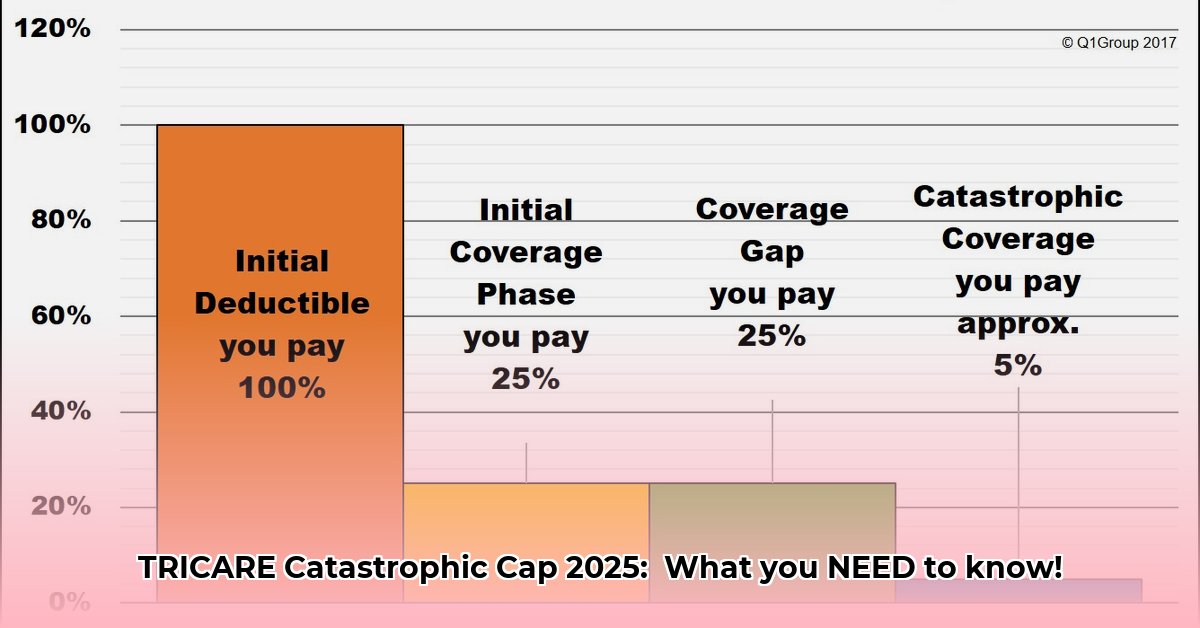

The TRICARE catastrophic cap is the maximum amount you'll pay out-of-pocket for covered healthcare services within a calendar year. Once you reach this limit, TRICARE covers 100% of eligible remaining expenses. This acts as a crucial safety net against overwhelming medical debt. But it's more complex than a simple dollar figure.

Isn't it reassuring to know there's a limit to your out-of-pocket expenses? This significantly reduces the financial risk associated with unexpected medical issues.

Decoding the Variables: What Influences Your Cap?

Several factors determine your specific catastrophic cap amount:

- Your TRICARE Plan: TRICARE Prime, Select, and other plans have different cost-sharing structures affecting your out-of-pocket maximum.

- Sponsor's Enlistment Date: Pre-2018 and post-2018 enrollment dates have different cost-sharing implications.

- Family Size: Larger families generally have higher caps due to increased potential expenses.

- Retirement Status: Active duty and retiree sponsors may have different catastrophic cap limits.

This complexity highlights why understanding your specific cap, rather than relying on general estimates, is vital.

TRICARE Plans and Estimated 2025 Catastrophic Cap Ranges

Remember, these are estimates. Always check the official TRICARE website for the most precise and updated information.

| TRICARE Plan | Estimated Catastrophic Cap Range (2025) | Important Considerations |

|---|---|---|

| TRICARE Prime | $3,000 - $6,000 (individual); $6,000 - $12,000 (family) | Ranges vary based on Group A or B designations. |

| TRICARE Select | $3,500 - $7,000 (individual); $7,000 - $14,000 (family) | Generally higher than Prime; check official limits carefully. |

| TRICARE For Life (TFL) | Generally Higher | This plan's limits are more complex and vary significantly. |

Group A vs. Group B: Understanding Cost-Sharing

The "Group A" and "Group B" distinction affects cost-sharing before reaching your catastrophic cap. Group A usually involves higher upfront costs, while Group B has lower initial costs. Your TRICARE explanation of benefits (EOB) will specify your group.

Estimating Your Out-of-Pocket Costs: A Practical Guide

Predicting medical expenses isn't exact, but these steps can help:

- Identify your TRICARE plan and group (A or B): This foundational information is on your TRICARE ID card or sponsor's military records.

- Assess your family's health needs: Consider routine checkups, chronic conditions, potential hospitalizations, etc.

- Consult the official TRICARE website: This is your primary source for 2025 cap amounts which are subject to change. Do not rely on secondary sources.

- Explore supplemental insurance: This can significantly reduce your overall out-of-pocket costs.

Proactive Financial Strategies: Planning for Healthcare Costs

Even with the catastrophic cap, unexpected expenses can strain finances. Proactive planning is crucial:

Actionable Steps:

- Create an annual healthcare budget: Include estimated costs; overestimate to allow for unexpected expenses.

- Build an emergency fund: Aim for 3-6 months' worth of healthcare-related expenses.

- Consider supplemental insurance: This provides an additional layer of financial protection.

Did you know that proactive financial planning can reduce stress and improve access to healthcare? It's an investment in your family's well-being.

Additional Resources

For detailed information and the most up-to-date figures, always refer to the official TRICARE website: https://tricare.mil/Costs/Cost-Terms/Catastrophic-Cap

Remember, this guide provides general information. Contact TRICARE directly with any specific questions. Understanding your catastrophic cap is key to responsible healthcare planning for your family.